Renters Insurance in and around Orlando

Looking for renters insurance in Orlando?

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

Home Is Where Your Heart Is

Being a renter doesn't mean you are 100% carefree. You want to make sure what you own is protected in the event of some unexpected catastrophe or damage. And you also need liability protection for friends or visitors who might become injured on your property. State Farm Agent Brandon Quarterman is ready to help you prepare for potential mishaps with dependable coverage for your renters insurance needs. Such individual service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If if trouble knocks on your door, Brandon Quarterman can help you submit your claim. Keep your home in a rental-sweet-rental state with State Farm!

Looking for renters insurance in Orlando?

Rent wisely with insurance from State Farm

Agent Brandon Quarterman, At Your Service

When the unpredicted tornado happens to your rented space or home, generally it affects your personal belongings, such as a video game system, a microwave or a TV. That's where your renters insurance comes in. State Farm agent Brandon Quarterman is committed to helping you examine your needs so that you can insure your precious valuables.

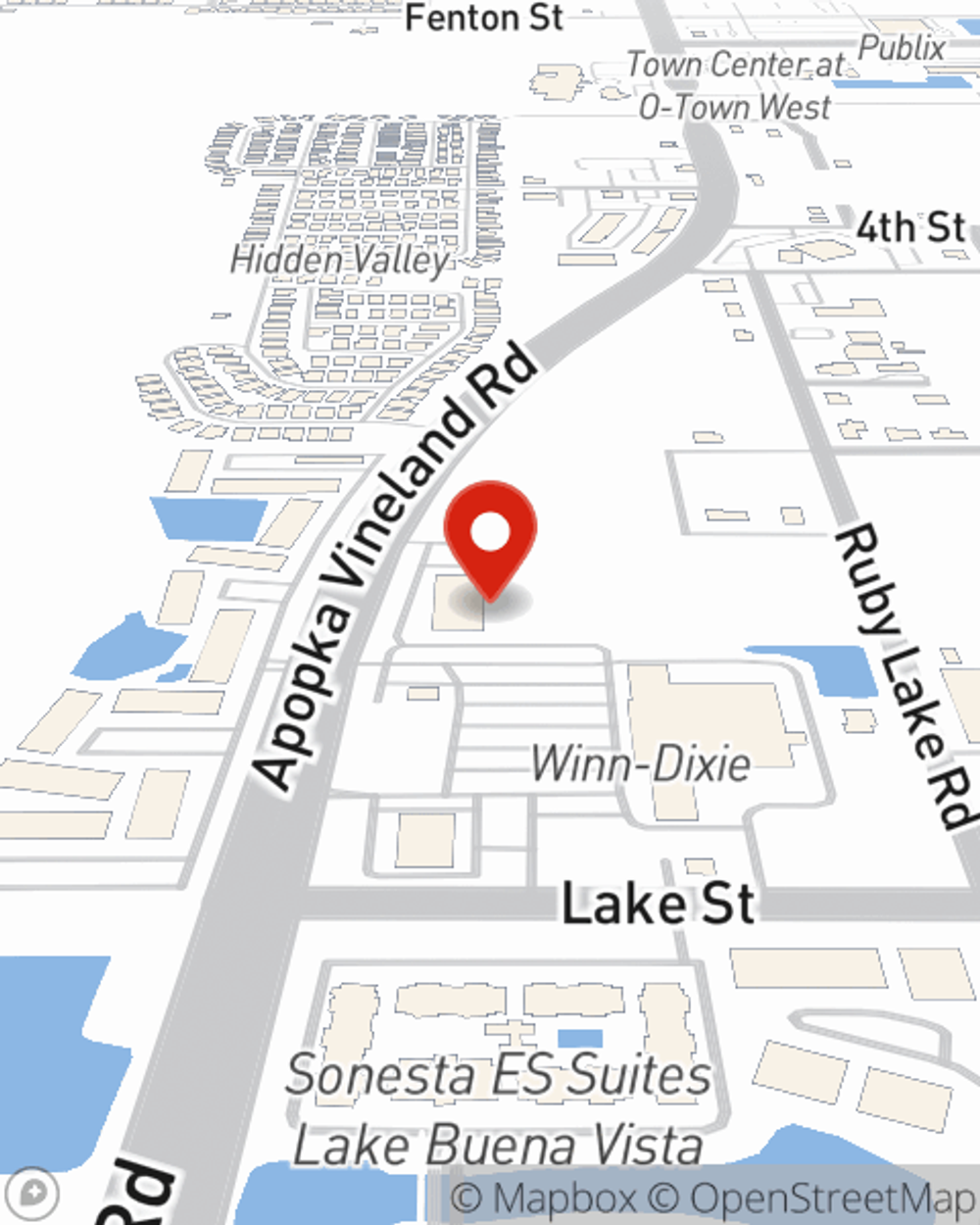

Contact State Farm Agent Brandon Quarterman today to explore how the trusted name for renters insurance can protect your possessions here in Orlando, FL.

Have More Questions About Renters Insurance?

Call Brandon at (407) 578-9130 or visit our FAQ page.

Simple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

Brandon Quarterman

State Farm® Insurance AgentSimple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.